Affiliate disclosure: purchases made throught the link may pay the affiliate a commision at no extra cost to you. Thanks for helping keeping the site running. Informational in nature only, not financial advice.

Whether you’re looking to safeguard your retirement through a Gold IRA or make direct precious metals purchases, choosing the right company is essential. This comprehensive guide examines the top precious metals companies of 2026, evaluating their offerings, customer service, pricing transparency, and overall value to help you make an informed decision.

The Economic Case for Precious Metals in 2026

The financial landscape of 2026 presents multiple challenges for investors. With persistent inflation concerns, growing national debt, and geopolitical tensions creating market instability, traditional investment vehicles alone may not provide adequate protection for your wealth.

Precious metals, particularly gold, have historically maintained their value during economic downturns. When stock markets falter and currency values fluctuate, physical gold and silver often move independently or even counter to these trends, providing crucial portfolio diversification.

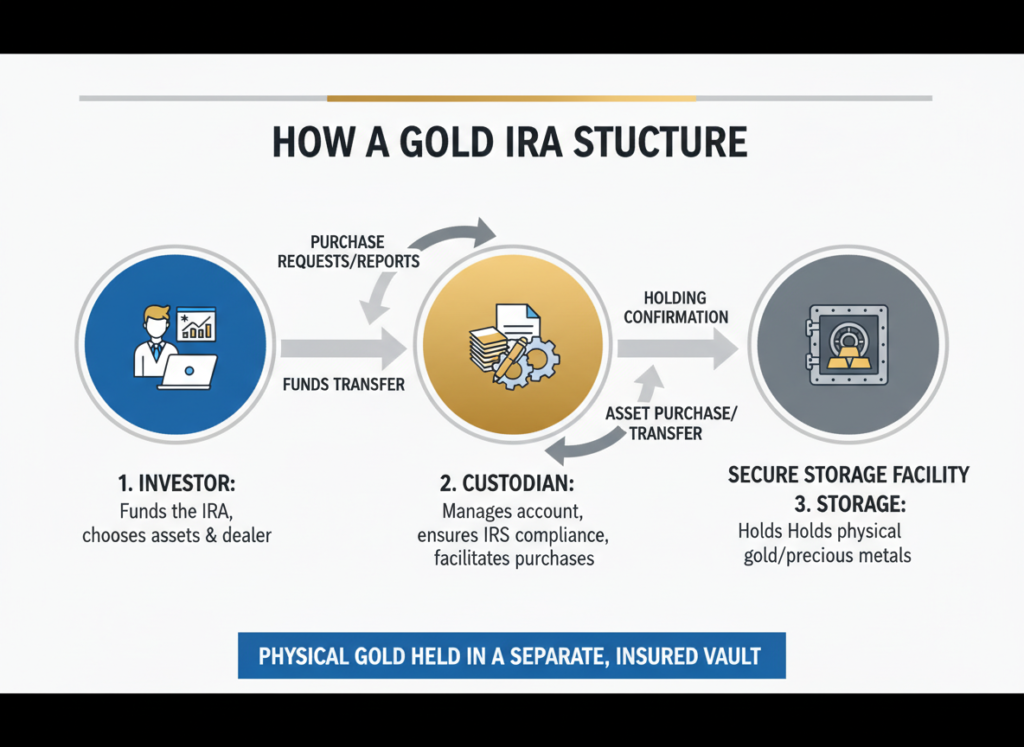

A Gold IRA (Individual Retirement Account) allows you to hold physical precious metals in a tax-advantaged retirement account, combining the stability of tangible assets with potential tax benefits. For those seeking direct ownership, purchasing physical precious metals offers immediate possession of these valuable resources.

Protect Your Wealth from Economic Uncertainty

Discover how Augusta Precious Metals can help safeguard your retirement with a Gold IRA backed by physical precious metals.

Augusta requires a minimum investment of $50,000. See other companies below if you are looking for a smaller minimum starting point.

Our Review Methodology

To identify the Best Precious Metals Companies of 2026, we conducted extensive research and evaluation based on several key criteria:

- Company Reputation: Years in business, industry standing, and customer feedback across multiple platforms

- Product Selection: Range and quality of precious metals offerings, including IRA-eligible products

- Pricing Transparency: Clear fee structures, competitive pricing, and absence of hidden charges

- Customer Education: Quality and accessibility of educational resources for investors

- Customer Service: Responsiveness, knowledge, and helpfulness of support teams

- Storage Options: Security, insurance, and flexibility of storage solutions

- Buyback Programs: Policies for repurchasing metals from customers

- Account Minimums: Investment thresholds for new customers

Each company was evaluated objectively against these criteria to provide you with accurate, reliable information for your investment decisions.

1. Augusta Precious Metals – Best Overall Precious Metals Company

Founded with a commitment to transparency and customer education, Augusta Precious Metals has established itself as the premier precious metals company in 2026. Their reputation for exceptional service and straightforward pricing has earned them consistently high ratings from customers and industry experts alike.

Augusta specializes in Gold and Silver IRAs, offering a streamlined process for rolling over existing retirement accounts. What truly sets them apart is their educational approach – rather than pushing for immediate sales, Augusta prioritizes helping clients understand the precious metals market through personalized web conferences and comprehensive resources.

Pros

- Industry-leading educational resources, including one-on-one web conferences

- Transparent fee structure with no hidden costs

- Lifetime customer support from dedicated account representatives

- Premium selection of IRA-approved gold and silver products

- Secure storage through the Delaware Depository with $1 billion in insurance

Considerations

- $50,000 minimum investment requirement

Best For: High-value investors seeking exceptional education and personalized service

Augusta Precious Metals is ideal for serious investors who value transparency, education, and personalized guidance. Their higher minimum investment threshold is offset by their exceptional service quality and commitment to customer education.

Start Securing Your Retirement Today

Augusta Precious Metals offers a free, no-obligation Gold IRA guide to help you understand how precious metals can protect your retirement savings.

Request Your Free Gold IRA Guide

Prefer to speak with a specialist? Call their dedicated support line:

2. GoldenCrest Metals – Best for Competitive Pricing

GoldenCrest Metals has quickly risen to prominence in the precious metals industry, earning a reputation for competitive pricing and exceptional customer service. While newer than some competitors, their commitment to transparency and client satisfaction has made them a standout choice for 2026.

What distinguishes GoldenCrest is their focus on making precious metals investing accessible to a wider audience. With lower minimum investment requirements and competitive pricing, they’ve removed many of the barriers that traditionally kept smaller investors out of the precious metals market.

Pros

- Highly competitive pricing with some of the lowest premiums in the industry

- Lower minimum investment requirements than many competitors

- Straightforward, transparent fee structure

- Excellent customer service with dedicated account representatives

- Streamlined account setup process

Considerations

- Newer to the industry than some established competitors

Best For: Cost-conscious investors and those new to precious metals

GoldenCrest Metals is particularly well-suited for investors who prioritize competitive pricing and accessibility. Their lower entry threshold makes them an excellent choice for those just beginning their precious metals investment journey.

Start Building Your Precious Metals Portfolio

Discover how GoldenCrest Metals can help you invest in precious metals at competitive prices with personalized guidance.

“GoldenCrest Metals offers some of the most competitive pricing we’ve seen in the industry, making precious metals investing accessible to a broader range of investors without compromising on quality or service.”

Take Advantage of Current Silver Price Surge

Learn about GoldenCrest’s special silver investment packages designed to capitalize on current market conditions.

3. Birch Gold Group – Best for Customer Education

With over two decades of experience in the precious metals industry, Birch Gold Group has established itself as a trusted name for investors seeking to diversify with gold, silver, platinum, and palladium. Their standout feature is their exceptional commitment to customer education, providing some of the most comprehensive resources in the industry.

Endorsed by respected public figures including Ron Paul, Birch Gold Group offers a wide range of IRA-eligible precious metals and direct purchase options. Their team of specialists includes former financial advisors and commodity brokers who provide personalized guidance based on each client’s unique financial situation.

Pros

- Industry-leading educational resources and market insights

- Diverse selection of precious metals, including gold, silver, platinum, and palladium

- Experienced team with backgrounds in finance and commodities

- Strong endorsements from respected public figures

- Established track record with over 20 years in business

Considerations

- $10,000 minimum investment for IRAs

Best For: Investors seeking in-depth education and diverse metal options

Birch Gold Group is particularly well-suited for investors who value comprehensive education and want to understand the nuances of precious metals investing. Their diverse product selection also makes them ideal for those looking beyond just gold and silver.

Get Expert Guidance on Precious Metals

Request Birch Gold Group’s comprehensive information kit to learn how precious metals can protect your wealth in today’s economic climate.

Special Offer: Birch Gold Group is currently waiving fees for the first year on qualifying accounts over $50,000. Contact them today to learn more about this limited-time opportunity.

Diversify Beyond Gold

Explore Birch Gold Group’s selection of platinum and palladium investment options for additional portfolio diversification.

4. Noble Gold Investments – Best for First-Time Investors

Noble Gold Investments has carved out a niche as the go-to precious metals company for first-time investors. Their approachable, no-pressure approach and exceptional beginner-friendly resources make the often-intimidating world of precious metals investing accessible to newcomers.

What sets Noble Gold apart is their commitment to simplifying the investment process. They offer clear, jargon-free explanations of investment options and provide personalized guidance tailored to each investor’s knowledge level and goals. Their unique “Royal Survival Packs” offer pre-selected collections of precious metals designed for specific investment objectives.

Pros

- Exceptionally beginner-friendly approach with no-pressure consultations

- Unique “Royal Survival Packs” for simplified investing

- Low minimum investment requirements

- Texas-based storage option (rare in the industry)

- Strong buyback program with fair market pricing

Considerations

- Smaller selection of rare coins compared to some competitors

Best For: First-time investors and those seeking simplified options

Noble Gold Investments is the ideal choice for those new to precious metals investing who value clear guidance and simplified options. Their approachable style and educational focus make them particularly well-suited for beginners.

Start Your Precious Metals Journey

Request Noble Gold’s free investment guide designed specifically for first-time precious metals investors.

Exclusive for New Investors: Noble Gold offers a complimentary consultation with a precious metals specialist to answer all your questions and help you understand your options without any obligation.

Explore Royal Survival Packs

Discover Noble Gold’s pre-selected collections of precious metals designed for specific investment goals and economic scenarios.

5. Lear Capital – Best for Customer Service

With nearly three decades of experience in the precious metals industry, Lear Capital has built a reputation for exceptional customer service and reliability. Their dedicated team of account executives provides personalized guidance throughout the investment process, earning them consistently high satisfaction ratings.

Lear Capital offers a diverse selection of gold, silver, platinum, and palladium products for both IRA investments and direct purchases. Their Price Advantage Guarantee ensures competitive pricing, while their Express IRA® program streamlines the account setup process for faster, more efficient investing.

Pros

- Industry-leading customer service with dedicated account executives

- Price Advantage Guarantee for competitive pricing

- Streamlined Express IRA® program for efficient account setup

- Extensive market experience with nearly 30 years in business

- Comprehensive buyback program

Considerations

- Educational resources less extensive than some competitors

Best For: Investors who prioritize personalized service and efficiency

Lear Capital is particularly well-suited for investors who value responsive, personalized customer service and efficient processes. Their streamlined approach makes them ideal for those who want to establish their precious metals investments quickly and with expert guidance.

Experience Premium Customer Service

Connect with Lear Capital’s dedicated team to learn how they can help you navigate precious metals investing with personalized guidance.

“Lear Capital’s customer service team consistently goes above and beyond, providing the kind of personalized attention and expert guidance that truly sets them apart in the precious metals industry.”

Learn About the Express IRA® Program

Discover how Lear Capital’s streamlined IRA process can help you establish your precious metals retirement account quickly and efficiently.

Comparing the Best Precious Metals Companies of 2026

| Company | Minimum Investment | Metals Offered | Storage Partners | Standout Feature |

| Augusta Precious Metals | $50,000 | Gold, Silver | Delaware Depository | Industry-leading education |

| GoldenCrest Metals | $25,000 | Gold, Silver | Multiple options | Competitive pricing |

| Birch Gold Group | $10,000 | Gold, Silver, Platinum, Palladium | Delaware Depository, Brink’s | Comprehensive education |

| Noble Gold Investments | $20,000 | Gold, Silver, Platinum, Palladium | IDS Texas, Delaware Depository | Beginner-friendly approach |

| Lear Capital | $5,000 | Gold, Silver, Platinum, Palladium | Delaware Depository | Express IRA® program |

Understanding Gold IRAs: A Quick Guide

A Gold IRA (Individual Retirement Account) is a self-directed retirement account that allows you to hold physical precious metals instead of traditional paper assets like stocks and bonds. These specialized accounts combine the tax advantages of conventional IRAs with the stability and inflation protection of physical precious metals.

Gold IRAs follow the same contribution limits and distribution rules as traditional IRAs but require specialized custodians and IRS-approved storage facilities. The metals must meet specific purity standards: gold must be 99.5% pure, silver 99.9% pure, and platinum and palladium 99.95% pure.

Key Benefits of Gold IRAs

Portfolio Diversification

Physical gold often moves independently of stocks and bonds, providing crucial diversification that can reduce overall portfolio volatility.

Inflation Protection

Gold has historically maintained its purchasing power during inflationary periods when the value of paper currency declines.

Tax Advantages

Gold IRAs offer the same tax benefits as traditional IRAs, allowing for tax-deferred or tax-free growth depending on the account type.

Ready to Protect Your Retirement with Precious Metals?

Augusta Precious Metals offers comprehensive guidance on establishing a Gold IRA to safeguard your retirement savings. (Augusta Requires a $50,000 minimum. If you are looking for a smaller minimum, see other options in above report.)

Direct Ownership of Precious Metals

While Gold IRAs offer tax advantages for retirement planning, direct ownership of precious metals provides immediate possession and greater flexibility. Many investors choose to maintain both IRA holdings and direct ownership to balance tax benefits with accessibility.

Forms of Direct Precious Metals Ownership

Bullion Coins

Government-minted coins like American Eagles, Canadian Maple Leafs, and Australian Kangaroos that combine precious metal content with government backing.

Bullion Bars

Ranging from 1-ounce to kilogram sizes, bullion bars typically offer lower premiums over spot price compared to coins.

Rounds

Coin-shaped pieces produced by private mints that offer the affordability of bars with the convenient size of coins.

Storage Considerations for Direct Ownership

- Home Storage: Provides immediate access but requires secure solutions like safes and may have insurance limitations

- Bank Safe Deposit Boxes: Offers institutional security but may lack insurance for precious metals and has limited accessibility

- Private Vaults: Combines high security with better accessibility than banks, often with specialized insurance

- Dealer Storage Programs: Many precious metals dealers offer storage solutions with buyback options for convenient liquidation

Start Building Your Physical Precious Metals Portfolio

GoldenCrest Metals offers competitive pricing on a wide range of gold and silver products for direct ownership.

Frequently Asked Questions About Precious Metals Investing

What percentage of my portfolio should be in precious metals?

Financial advisors typically recommend allocating 5-15% of your investment portfolio to precious metals, depending on your risk tolerance, investment goals, and economic outlook. During periods of high inflation or economic uncertainty, some investors choose to increase this allocation. It’s best to consult with a financial advisor to determine the right percentage for your specific situation.

Can I hold physical gold in my existing IRA?

Standard IRAs with traditional custodians like banks and brokerage firms typically don’t allow physical precious metals. To hold physical gold, you need to establish a self-directed IRA with a specialized custodian that permits alternative assets. This requires rolling over funds from your existing IRA or making new contributions to the self-directed account.

What are the storage requirements for Gold IRA metals?

IRS regulations require that precious metals in an IRA be stored in an approved depository under the custodian’s supervision. Home storage is not permitted for IRA metals. The depository must provide secure, segregated storage with full insurance coverage. Most Gold IRA companies work with established depositories like Delaware Depository, Brink’s, or International Depository Services.

How do I liquidate precious metals when needed?

Most reputable precious metals companies offer buyback programs that allow you to sell your metals back to them at competitive market rates. For IRA-held metals, your custodian will coordinate the sale and deposit the proceeds into your IRA account. For directly owned metals, you can sell to dealers, private buyers, or through online marketplaces. The best companies provide clear, transparent buyback policies with minimal fees.

Are there tax implications when investing in precious metals?

For Gold IRAs, the tax treatment follows the same rules as traditional or Roth IRAs. With traditional Gold IRAs, contributions may be tax-deductible, and taxes are paid upon withdrawal. With Roth Gold IRAs, contributions are made with after-tax dollars, but qualified withdrawals are tax-free. For direct ownership, precious metals are typically treated as collectibles by the IRS and subject to a maximum long-term capital gains tax rate of 28% when sold at a profit.

Still Have Questions About Precious Metals Investing?

Augusta Precious Metals offers comprehensive educational resources and one-on-one consultations to answer all your questions.

(Augusta requires a minimum investment of ,000)

Final Thoughts: Choosing the Right Precious Metals Company

Selecting the right precious metals company is a crucial decision that can significantly impact your investment experience and outcomes. Each of the companies reviewed in this guide offers unique strengths and specializations to meet different investor needs.

For those seeking comprehensive education and exceptional service, Augusta Precious Metals stands out as our top overall recommendation. Investors prioritizing competitive pricing will find GoldenCrest Metals particularly appealing, while those new to precious metals investing may prefer the beginner-friendly approach of Noble Gold Investments.

Regardless of which company you choose, investing in precious metals offers valuable portfolio diversification and a hedge against economic uncertainty. As we navigate the complex financial landscape of 2026, physical gold and silver continue to serve as trusted stores of value with thousands of years of proven reliability.

Take the Next Step in Securing Your Financial Future

Request a free consultation with one of our top-recommended precious metals companies to discuss your specific investment needs and goals.