Affiliate Disclosure: The owners of this website may be paid to recommend the following companies: Goldco, Augusta Precious Metals, Noble Gold Investments, Birch Gold, and Regal Assets. The content on this website, including any positive reviews of the mentioned companies, and other reviews, may not be neutral or independent.

Best Gold IRA review. While it may be tempting to follow the big name and go with the company that has the most glowing client testimonials, the best way to find a legitimate company is to look for an A+ rating from the Better Business Bureau. A solid retirement savings plan is important for peace of mind and a secure financial future. However, choosing the right company doesn’t have to be a time-consuming or difficult task. This article will explain why.

Best Gold IRA Review: Noble Gold

In this Best Gold IRA IRA Review, I will explain my experience with this company. While I do not invest personally in the company’s products, I’m sure you’ll find some useful information on their website. For example, Noble Gold does not use hard sales tactics but instead offers transparency and unbiased advice. You can invest as little as $2,000, which is relatively low compared to other precious metals investment options.

When investing with Noble, you have the benefit of secure storage for precious metals, free metals exchange, and superior customer service. The company is well-known for its commitment to customer satisfaction and has an A+ rating with the Better Business Bureau. Lastly, their mission is to help you build a successful future through the purchase of precious metals. No matter what your goals or circumstances, they can help you create a successful investment plan.

Setting up an account with Noble Gold is simple and quick. They also offer professional advice and support, and you can set up an account online. They charge low annual fees compared to other firms, and they are transparent about their fees and how they are calculated. IRA fees vary depending on the investment options you choose, but they’re still quite reasonable. You can open an account online, and a Noble Gold representative will guide you through the process of setting up your IRA.

Another unique feature of Noble Gold one of the best gold IRA companies, is that you can view your investments at any time. In addition, you can choose the precious metals you want to invest in, including silver, gold, and platinum. You can even invest in rare coins and collectible coins. The company also has an extensive media presence and has co-founders who have even acted as pundits for the precious metals industry. Furthermore, it boasts more than 400 customer reviews online and has a five-star total score.

In this Best Gold IRA Review, I will outline how to set up a gold IRA account with the company. It’s easy to invest in gold as a retirement account and it can diversify your investment portfolio. You can also invest in rare coins that are difficult to find elsewhere, which adds a touch of sentimental value to your retirement portfolio. Noble Gold offers all of these options at affordable prices, so you can invest in precious metals without breaking the bank.

When choosing a custodian, always look for a company that maintains a strong connection with its clients. The Noble Gold team is comprised of two experienced executives, Colin Plume and Charles Thorngren. Together, these individuals have over two decades of investment experience, and they understand the intricate details of precious metals IRAs. And they’re happy to help you get started! So, why wait? Get started today with Noble Gold.

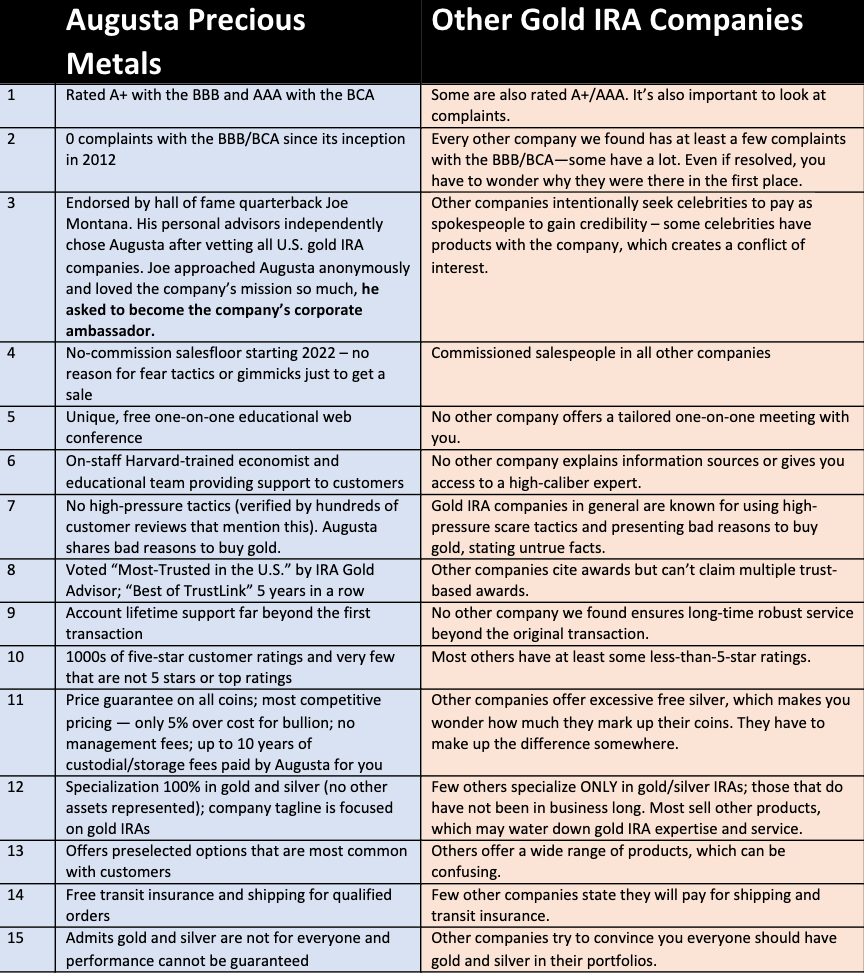

Augusta Precious Metals (Our Favorite Pick!)

When it comes to investing in gold and silver, a wise decision is to buy an IRA at a company that specializes in precious metals. Buying precious metals is a long-term project. In this Augusta Precious Metals IRA review, we’ll look at the pros and cons of purchasing gold and silver through an IRA with Augusta. These precious metals have the potential to boost your retirement account, and Augusta is a top choice when it comes to this type of investment highlighted in this best gold IRA review.

To read our full blog post on Augusta, click here.

Augusta Precious Metals has many advantages. The company partners with International Depository Services Group and Brinks Global Services to store client assets. They also ship precious metals to their customers’ mailboxes, and the company promises to refund any lost or stolen precious metals. Aside from excellent storage options, Augusta’s services are easy to use and convenient. IRA holders will receive their metals promptly. And their packages are discreetly packaged to avoid unwanted attention.

The Augusta Precious Metals Company offers plenty of information online. Customers can take advantage of its high customer satisfaction ratings and its attractive pricing structure. The company offers a free gold IRA guide and Joe Montana, a hall of famer, is a spokesperson for the company. If you’re unsure about whether this investment is right for you, read on for an Augusta Precious Metals IRA investment review.

Augusta Precious Metals is a well-known custodian of gold and silver. It works with three custodians, including GoldStar Trust Company, Kingdom Trust, and Equity Trust. Moreover, it accepts existing retirement accounts. Augusta will send the precious metals to secure locations. IRAs with Augusta require a minimum investment of $50,000. Aside from that, the company offers lifetime access to agents and offers a number of other benefits.

The company has a stellar reputation, with a 5.0 TrustLink rating and many satisfied investors. The company’s staff members are highly-qualified and encourage their customers to interact with them to fully understand the investing process. Augusta Precious Metals has been accredited by the Better Business Bureau with zero complaints. Among Augusta’s other impressive credentials, Nuriani has served on the boards of several Silicon Valley companies.

For people with experience in precious metal investing, Augusta Precious Metals offers educational webinars. It also donates a portion of its net proceeds to charities such as K9s For Warriors. Additionally, the company works with three gold IRA custodians. Customers can set up self-directed IRA accounts with Augusta or rollover funds from an existing retirement account. A full list of benefits is provided on its website.

If you’re interested in purchasing gold or silver coins or silver, you can speak with an Augusta Precious Metals agent. Their representatives will walk you through the steps involved, and agents will personally answer all questions. The company also offers a comprehensive education department, which will answer any questions you have. You can also get help with paperwork by contacting their order desk. This company has a strong reputation with the Better Business Bureau and Business Consumer Alliance, and there have been zero complaints filed against them.

Gold Allied Trust

If you’re in the market for a gold IRA investment, you’ve probably wondered how the process works. While conventional IRAs can contain stocks, bonds, and mutual funds, the gold IRA allows you to own physical precious metals. While some gold IRA companies advertise that their fees are low, few actually disclose what they charge. Augusta Precious Metals has an easy-to-understand pricing structure. This allows you to determine the fees that each company will charge you.

While the buyback process is relatively fast, it can be time-consuming and may even take several months before funds reach your account. Still, it is a strong selling point for investors, and they won’t be put off by the company’s rigid rules and high-pressure sales tactics. Moreover, the minimum account balances are reasonable and the buy-back program is liberal – even higher than most competitors’.

Applicants for a gold IRA must contact the company. Once they do, they will receive an application that should take about ten minutes to fill out. Then, they must mail it in a prepaid envelope. Upon receiving the application, you should receive the account activation letter within 24 hours. Other gold IRA providers offer phone and online applications. These companies usually have lower fees than competitors. The best way to determine if a gold IRA investment is right for you is to compare the fees charged by different providers.

While some companies charge liquidation fees and don’t have the best transparency when it comes to selling back your metals, Advantage Gold is the exception. It makes the process easy. You can sell back your precious metals any time you wish to, and they pay spot prices for most of the metals. A few gold IRA companies do have a minimum purchase requirement, but Advantage Gold’s fees are relatively low.

Gold IRAs are a popular way to invest in physical gold. Many companies offer gold IRAs, but they come with numerous terms and fees. Before making an investment, it’s best to learn about the risks and rewards of gold investments. These companies often provide self-directed gold IRAs as well as physical precious metals IRAs, and their websites are packed with helpful tools. The gold IRA investment review below highlights the benefits and disadvantages of the gold IRA investment.

One of the biggest advantages of owning physical gold is that it offers built-in tax benefits. Another benefit of IRAs is that they are generally long-term investments. Physical gold is not very liquid, so it’s best for seniors and older individuals who don’t want to risk their retirement savings. After all, if your savings are lost, it can take years for your money to recover. The benefits of owning physical gold are well worth the risk.

12 thoughts on “Best Gold IRA Review”

Comments are closed.