Affiliate Disclosure: The owners of this website may be paid to recommend the following companies: Goldco, Augusta Precious Metals, Noble Gold Investments, Birch Gold, and Regal Assets. The content on this website, including any positive reviews of the mentioned companies, and other reviews, may not be neutral or independent.

Birch Gold Group Reviews – Red Flags to Watch Out For

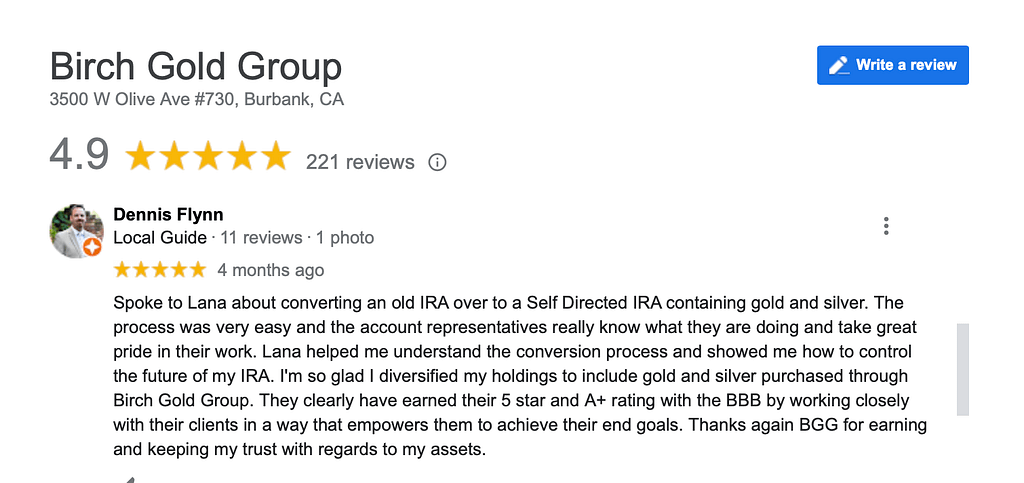

If you’re looking for a company that’s well known and has high customer service standards, you may want to consider the Birch Gold Group. The company is headquartered in Burbank, California and markets its services across the United States. Their services have been featured in major media and advertise heavily on conservative programs. On their website, you’ll see an impressive number of 5-star customer reviews. Links to third-party review websites help you read what other consumers are saying about the Birch Gold Group in Birch Gold Group reviews.

Birch Gold Group has a good reputation

If you are looking for a trustworthy investment manager, you should check out the Birch Gold Group’s reputation. The company has been in business since 2003 and has thousands of satisfied customers across the United States. They have received favorable ratings from the Better Business Bureau and the Business Consumer Alliance and hundreds of 5 star reviews from verified customers. The Birch Gold Group has a strong reputation and has appeared on many conservative media outlets, including Ben Shapiro’s Ben Shapiro Show.

The Birch Gold Group also helps you set up your self-directed IRA. You can fund your account using any of several types of legitimate IRAs, including the 403(b) and 401(k) accounts. You can even transfer a portion of your current IRA into a gold IRA. This investment firm also matches potential investors with gold IRA specialists. Investing in precious metals has never been easier!

Moreover, the Birch Gold Group’s reputation is well-deserved. Their long-term support and care for clients have earned them a good reputation among customers. When customers had to make adjustments to their IRAs, they received the same attention as when they first signed up. The company also contributes to Operation HOPE, a non-profit organization dedicated to financial education and empowerment of Americans.

The company has an impeccable reputation, and the top management is a part of Forbes Finance Council. Consumers have been pleased with the company’s personalized attention and convenient payment options. Customers are also free from purchase-related reporting obligations. This is a major plus for Birch Gold Group. But beware of scams. Birch Gold Group has an excellent reputation for educating customers and avoiding pitfalls. This investment firm is well-known for a good reputation.

Despite its low-profile, the Birch Gold Group charges their clients for fees. The $50 initial setup fee and $30 wire transfer fee is mandatory for all accounts, though the latter is waived in the first year. Annual management fees are $80 and cover the expenses of insurance and storage. Clients can invest as little as $10k per year. Besides these fees, Birch Gold also does not charge fees based on asset value.

It offers a wide range of products

The Birch Gold Group is a reputable precious metals company that is dedicated to helping customers discover the many benefits of owning and investing in precious metals. With its strong reputation, outstanding track record, and exemplary customer service, this company stands out from its competition. Whether you’re an individual or an institution, they are a good fit for your precious metals investment needs. As such, they are highly regarded by numerous review websites and have received top scores with the Better Business Bureau and Business Consumer Alliance.

Based in Burbank, California, the Birch Gold Group has expanded its marketing efforts to the entire United States and has been featured in a number of major media outlets. Its products and services have a positive reputation, and they regularly advertise on conservative television and radio programs. Customers can browse Birch Gold Group’s website to read customer reviews and check their reputation.

Whether you’re a newbie to precious metals or an experienced investor, you can choose from a wide range of products to diversify your portfolio and secure your financial future. The Birch Gold Group offers a Triple A rating from the Business Consumer Alliance and an A+ rating from the Better Business Bureau. Aside from buying physical precious metals, the Birch Gold Group also offers two secure storage options for Precious Metals IRAs.

As an independent and reputable company, the Birch Gold Group also provides a comprehensive suite of retirement services and investment products. The Birch Gold Group SDIRA provides investors with complete control over their investments and extra flexibility in making decisions regarding the type of investments they make. Because a Birch Gold Group SDIRA does not have a traditional investment mandate, they allow clients to diversify into non-conventional assets, such as precious metals, real estate, and even businesses. Thus, they can protect their retirement wealth during difficult times in the financial world.

The Birch Gold Group began in 2003 in Southern California and has since expanded to serve clients across all states of the country. With a team of experienced financial advisors, commodities brokers, and wealth managers, the company is among the nation’s most trusted precious metals dealers. In addition to its diverse offerings, the Birch Gold Group’s knowledgeable and friendly staff members are dedicated to providing their clients with the best service possible.

It offers personalized service

With a history of almost two decades, Birch Gold Group has served thousands of clients in the United States. While some clients are dissatisfied with their experience, many are content with the personalized service and educational resources. While some customers have complained about commission costs and volatility of the market, reviews are generally positive and are worth reading. This is particularly true for the company’s online reviews, where it has been awarded an AAA rating by the Business Consumer Alliance.

While other investment companies are more focused on making money than educating their customers, Birch Gold Group emphasizes education. Their website is loaded with information about Gold and the Precious metals that they deal in. Birch employs specialists who are well-versed in the details of these metals and understand investors’ concerns. Ultimately, due diligence means asking questions. By ensuring that you have the answers to your questions, Birch Gold Group is on your way to providing personalized service to its clients.

As an IRA-approved company, Birch Gold Group has helped thousands of Americans make the right investment decisions. Through its in-house IRA Department and the help of dozens of Precious Metal Specialists, they help their clients diversify their savings. The company’s personalized service and education make them the perfect partner for any investor looking to invest in precious metals. These metals provide stability and a balance to unpredictable market situations.

Customers can expect to receive personalized service from Birch Gold Group, as its financial experts are experts in the industry. Birch Gold Group’s customer service has a stellar A+ rating from the Better Business Bureau, and it consistently receives positive feedback from clients. The company has a clearly laid-out process for customer service. The firm’s support staff will help you through the process of opening an account. Once you’ve completed the initial paperwork, you’ll be given a personalized service representative to help you decide whether to open an account or not.

Customers can invest in precious metals through Birch Gold Group, which offers an individual retirement account. This is different from an IRA rollover, and Birch Gold Group assigns an agent to guide them through the process. The agent will walk you through the options, help you choose your metals, and make the payment process easier. They accept wire transfer and personal checks to facilitate the process. There are many benefits to choosing Birch Gold Group for your personal investments.

It has high standards of customer care

The Birch Gold Group is committed to providing exceptional customer service and educational materials to investors. To help investors understand gold and other precious metals, the group offers a free 22-page information kit, which includes a description of gold as a hedge. The information kit also includes basic information on IRAs and the benefits of owning these precious metals. The company excels in customer service and investor education, and has a comprehensive library of educational materials. The company’s high standards of service are further reinforced by its award-winning “AA” rating from the Business Consumer Alliance.

In addition to high BBB and BCA ratings, Birch has received many positive reviews from customers. Its complaints have been handled efficiently, and it has received only two reports from government agencies. Its customer care team consistently responds to complaints within weeks. Although there have been some complaints about the company’s customer service, they have consistently received a high rating from customers and industry monitors. Overall, the company has an A+ rating with the BBB.

The Birch Gold Group has built a reputation on empowerment. The company aims to educate customers rather than make sales. By educating customers on precious metals IRAs, the company puts the power in their customers’ hands. They believe that empowering customers is key to long-term success. The company is committed to high standards of customer care and strives to act with transparency and integrity. And if you’re still not sure about the company’s high standards, read on!

A team of specialists helps Birch Gold Group clients with their accounts. The representatives walk customers through the signup process, answer questions, and help them open an account. The agents are knowledgeable and can guide you to the department that can answer your questions. They can also help you select which coins and bars to invest in, and provide education about different products and how to make the best use of your money. When it comes to preserving your assets, the Birch Gold Group puts customer education first.

When you’re ready to invest in gold, consider using a gold IRA with Birch Gold Group. The fees are relatively low. Birch Gold Group works with Equity Trust Company, the custodian of gold IRAs. You’ll have to pay a $50 account opening fee to start an account, but you won’t pay a monthly fee with Birch Gold. Then, you’ll pay an annual custodian fee of $180. You’ll also have to pay $30 for wire transfers to and from your account.

Request your free kit from Birch Gold Group now!

With over two decades of service and a high volume of customers, the Birch Gold Group is certainly no newcomer to the industry. They have a stellar reputation thanks to a number of positive online reviews and customer complaints. A Google search will quickly turn up any disgruntled customers with a negative review of the company. While most Birch Gold Group reviews are positive, you should make sure to read Consumer Reports’ disclaimers carefully, as there are red flags with this particular company.

First, consider the amount of minimum investment that is required. The Birch Gold Group recommends a minimum amount of $10,000 per account. Accounts with fifty thousand dollars or more are exempt from initial setup, maintenance, wire, and storage fees. While this isn’t a high amount, it’s still worth noting that there are very few fees at Birch Gold Group. You’ll have to pay a one-time $50 setup fee and a $30 wire transfer fee.

The Birch Gold Group has built its reputation on a solid track record and investor trust. Its website also offers articles covering precious metals ownership, numismatic coins, and 401k rollovers. They have valuable market information and charts available to their customers, and a free 2021 information kit to learn more about precious metals investment. Lastly, their customer satisfaction surveys and reviews are both positive. Visit them here!

There are several benefits to using a retirement account from the Birch Gold Group. While their fees are not based on the total value of your assets, they do charge a fee of $80 per year for managing your account. The company recommends an investment of at least $10,000 to open an account, which is higher than many competitors’ minimums. Birch also works with two reputable storage companies – Brink’s Global Services and Delaware Depository.

As a registered custodian, the Birch Gold Group works with you to establish an IRA and choose a precious metal that fits your investment needs. While many precious metals are approved for IRAs, the Internal Revenue Service does not approve all of them. Therefore, your investment advisor should recommend a reputable custodian and make recommendations based on their own research. Birch Gold Group also ships your precious metals to approved depositories such as the Delaware Depository and Brink’s Global Service, where they are stored in secure vaults.

The Birch Gold Group employs certified experts who have decades of experience in the field. They have worked with renowned firms, and their staff members have decades of experience in the industry. When you contact the Birch Gold Group for assistance with your investment needs, they will walk you through the entire process step by step, and will recommend viable options based on your investment goals and budget. You can also rely on their team to help you locate funds for your investment, making the rollover process hassle-free.

Before you invest in Gold IRAs, it’s important to find out what makes a company IRA approved. It should have a reliable buyback system, allowing you to sell your metals at market value. It should also offer secure storage facilities. Many people forget about this aspect, but it is one of the most important. Companies that have segregated storage facilities can help ensure that your gold is safe while IRA-approved.

The top gold IRA companies have excellent reputations. They consistently receive high customer ratings. They have received thousands of five-star reviews and have been named the Most Trusted Company in the U.S. by leading ranking companies. They also have a customer-centric nature, offering clear and concise information to help their customers understand how their gold IRA investments work. This allows you to make informed decisions that will benefit your financial future.

IRA Approved gold should not be stored at home, as it could be stolen or even sold by rogue investors. It is also not insured, so if you store your gold at home, you risk it being stolen or switched to gold that doesn’t meet the purity standards required by the IRS. Keeping your gold in a secure depository will keep it safe and allow you to access it at any time.

If you’ve never owned gold in your life, you’ll be pleased to learn that you can now invest in IRA gold. There are various ways to invest in gold, from rare bars to rounds. You should always check with your IRA provider to determine whether they offer other options. IRA gold must be stored in an IRA-approved depository. This ensures high security levels, insurance, and other protections for their clients. Physical gold is extremely safe.

If you’re wondering whether to invest in gold and silver IRAs, you’re not alone. More people are considering this option for retirement. The combination of stability, growth, and protection makes it an attractive investment. Gold and silver IRAs come with strict requirements and must be purchased from US-accredited manufacturers or sovereign mints. The only exceptions to these requirements are the 400-ounce gold bar and a certain weight of silver.

While many companies offer this option, you should be aware that there are substantial holding and purchase costs associated with precious metals. These costs include base fees and storage fees. Companies like Rosland Capital, for example, charge $50 to open an account and $225 a year to store your holdings. While some gold and silver IRA sellers waive these costs for new customers, these fees are typically incurred because of the high demand for the metal.

Although prices have fallen in recent years, they remain strong historically. Gold prices peaked in 2010 and were over $1,700 per ounce by the end of 2012. Silver prices have risen over the past decade but are still weak compared to gold. During the early 2000s, silver sold for a few dollars an ounce. Now, it is worth more than $26 per ounce. Purchasing real estate is another good way to build wealth. Rental properties can provide passive income while the price continues to rise.

If you’re looking for a safe, hassle-free way to invest in precious metals, a gold and silver IRA is a wise choice. However, you should make sure that you’re using a reputable company to invest in gold and silver. These companies are usually rated high by customers, the press, and the BBB. When selecting a gold and silver IRA, be sure to check the credentials of the company you’re considering.

6 thoughts on “Birch Gold Group Reviews”

Comments are closed.